The 50/30/20 Rule

Start simple when thinking about budgeting. You can always adjust as you get to know your specific spending habits, but 50/30/20 is a good general rule for beginners. Dedicate 50% to needs, 30% to wants and 20% to long-term savings.

The word “needs” is a tricky one. Needs include expenses like housing, transportation, utilities, insurance and health care; however, you can always opt for a more affordable car, downsize to a smaller house or save by switching insurance. This is just something to think about, and tracking your budget may help you make those types of decisions in the future.

Wants are simple. These are expenses from activities like eating out, subscribing to streaming services, buying a nice outfit or taking a vacation. These are the easiest things to cut down on, and that’s part of why they should make up a smaller portion of the budget compared to your needs.

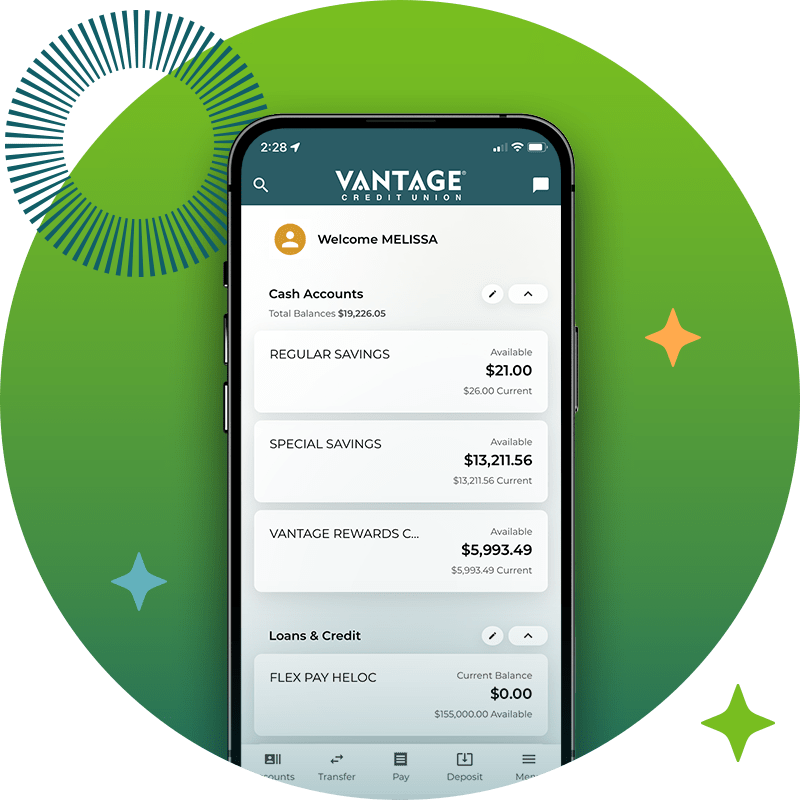

20% is a good benchmark for savings, but what are these savings for, exactly? Planning for retirement and preparing for emergency expenses are two goals you could focus on. And modern technology makes saving easy too—set up automatic transfers with your financial institution or request your direct deposit to be split into different accounts.